Evidence #9

Charts covering the rise of AI, Chinese innovation, social media, globalization, and US inequality.

Interested to get these notes? Subscribe here.

Evidence is a dinner series where guests each share a chart that is "evidence of a changing world.” Charts can be about anything, from a trend in popular culture to a breakthrough in science, and are meant to get people thinking about the future. These dinners are hosted by Damir and Dino and supported by Index Ventures.

This dinner was hosted in NY. We were joined by:

1 engineer at a leading LLM company

3 product managers from leading social media and fintech companies

1 founder of a sports betting business

1 founder of a marketing technology business

1 investor at a venture capital firm

1 hedge fund investor

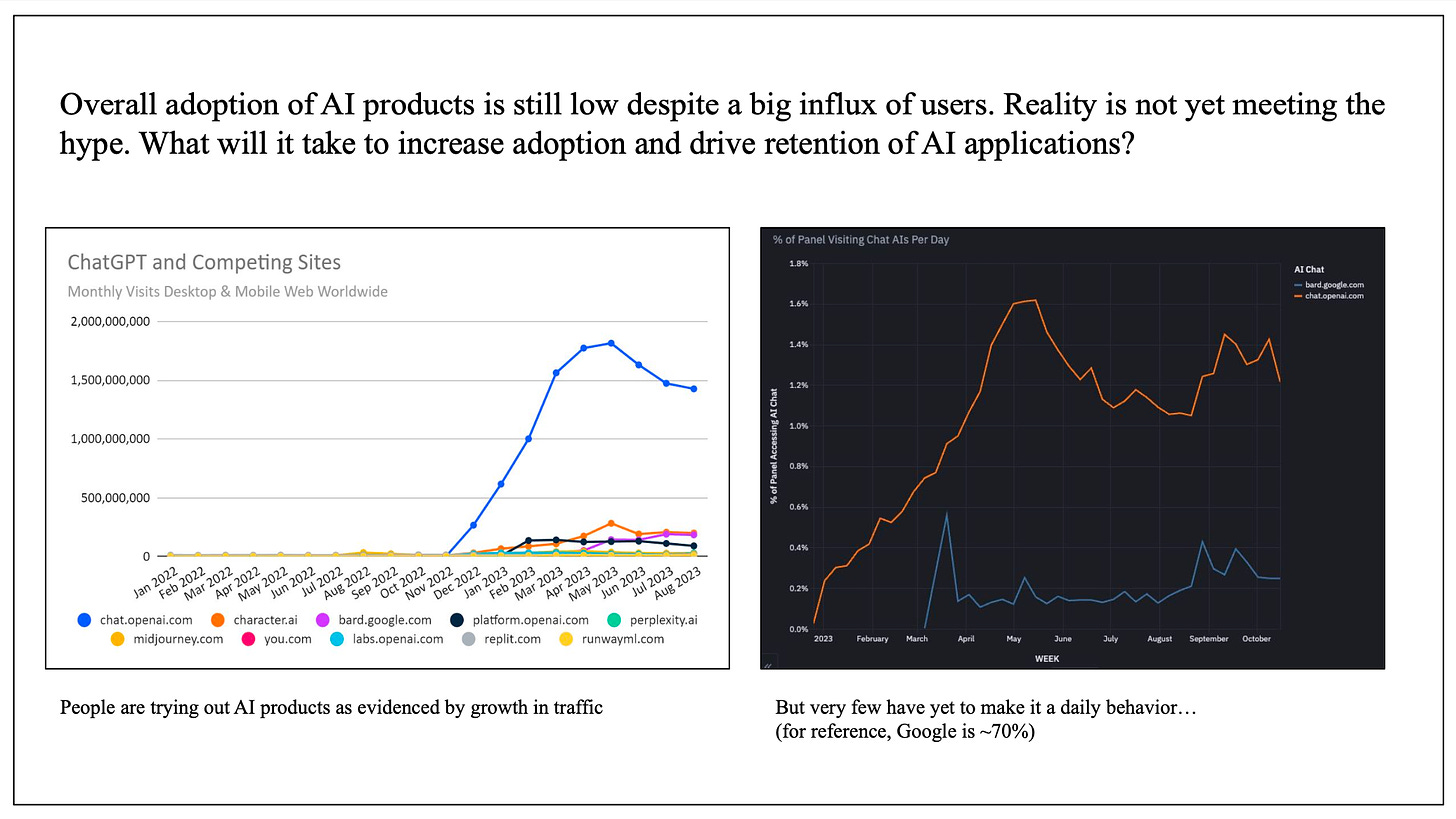

Is AI too hyped up? Retention for products so far seems quite dismal.

What consumer internet products will solve real problems and become habitually used? We spent most of the time discussing specific ideas. Perhaps AI will help consumers simulate dates and help them find a better match without having to go on a lot of dates. We also discussed how other forms of “synthetic” identity, like avatars, may allow consumers to connect with one another virtually. Perhaps we can learn a lot more about each other on the internet going forward - not just what we see through photos.

We also envisioned certain use cases that require a lot of toil and friction today - such as creating a travel itinerary and researching products we want to buy online. “Amount of time and # tabs open” may be useful ways to hone in consumer transactions that could be improved by AI.

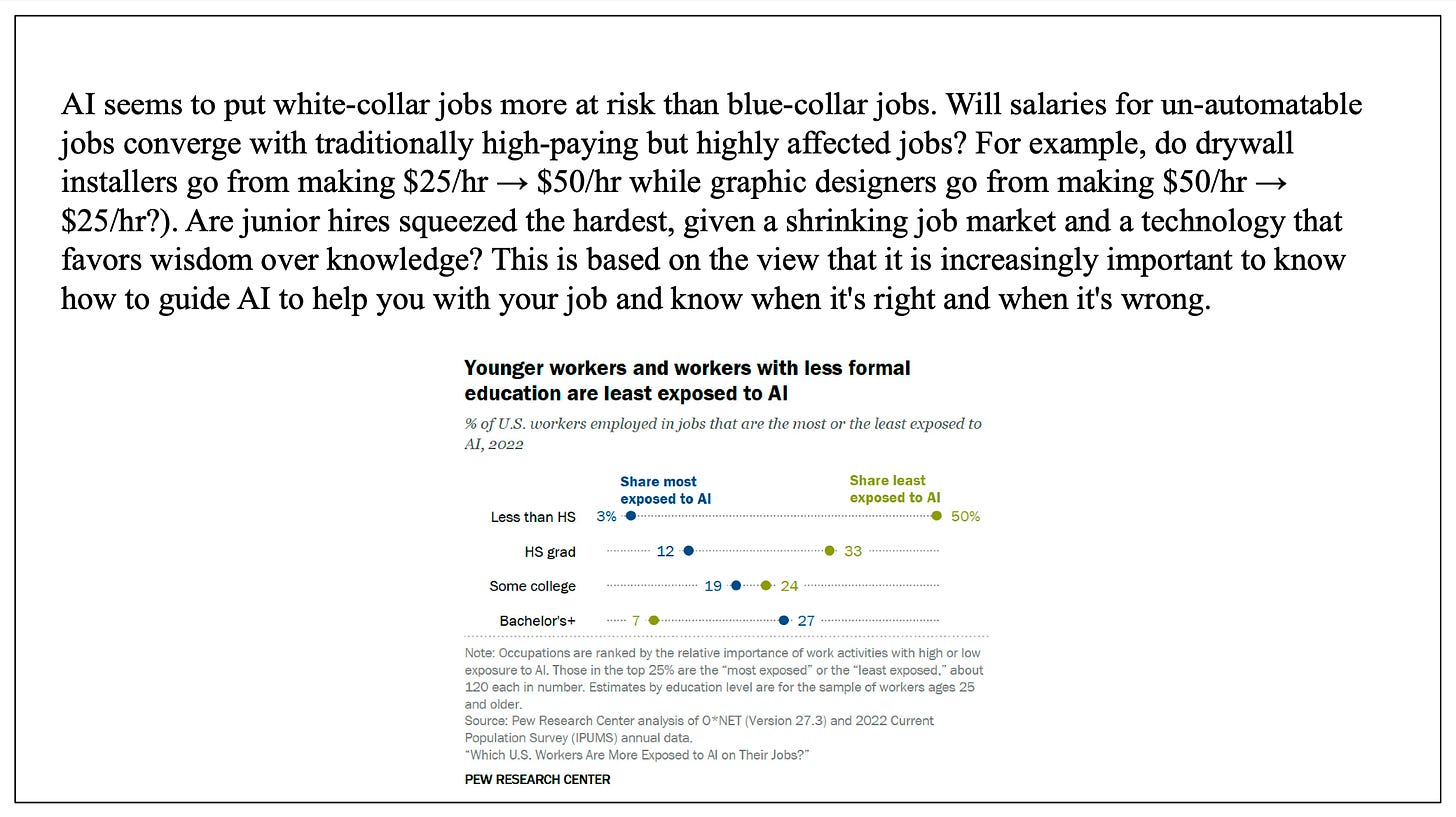

AI today is operating at the level of a smart high school student. Soon it will be a 25 year old college grad and able to give users a lot of leverage. We generally agreed that many jobs will see the emergence of “AI copilots” that allow a single user to do the work of an entire team. A single user may, for example, be able to define an entire design system and implement it through an entire product. Will this lead to a lot of layoffs of knowledge workers in software engineering, design, marketing, and beyond?

Will the digital future be dominated by a few dozen technology companies that become the “lords of the digital realm”? And relatedly, has society been allocating too many humans towards software development and sales? Perhaps the software sales reps of today will become the electricians and plumbers of the future. We’re certainly struggling to find labor for physical jobs today - the US has 8.7m open jobs against 6.3m currently unemployed people. Or perhaps sales reps will become more important than ever as trust becomes more important.

There was general agreement that AI is going to have massive impact and that we’re just at the beginning of this wave of progress. Optimists believed that AI will unlock more human creativity and connection and lead to the end of middle management. It may also truly drive the next wave of startups as certain incumbents struggle to cannibalize their existing products/businesses from AI-first ones.

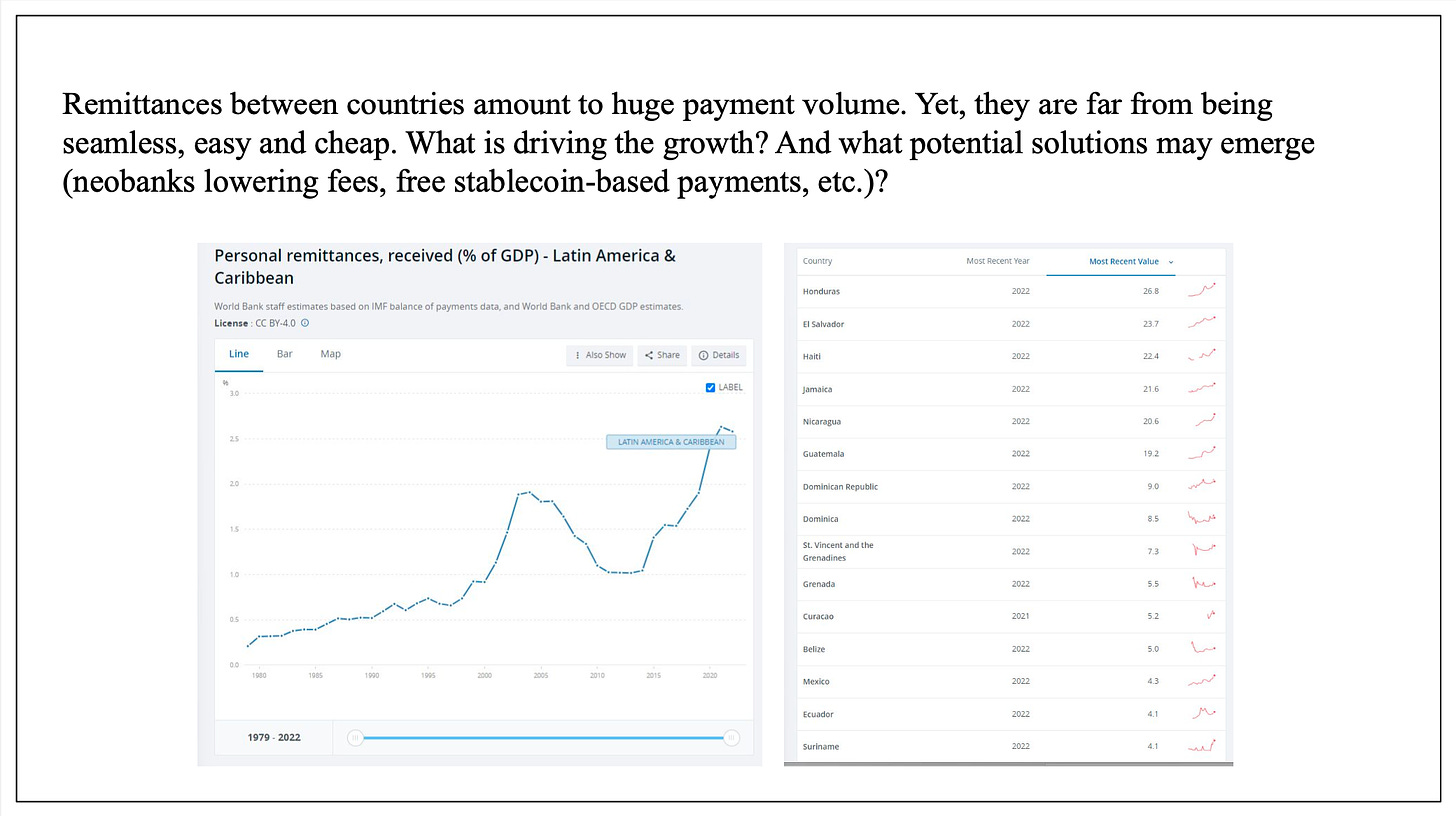

In certain countries remittances equate to >20% of GDP! One way to infer this is that these countries are being “fed” by other countries. Will volume only continue to grow as the large economies import more labor via immigration to fill jobs no one else wants to do?

Large remittance volumes (>$50b) are still transacted at physical branches like Western Union that charges 6% fees. Is the usage of branches tied to unbanked populations? And is there an opportunity to bring down the cost? We discussed Transferwise which is a promising company aimed at this problem. The company offers remittances that cost 60 bps instead of 6% and they are on a stated mission to take this down to 0%. Their product works by keeping money in countries and trading currencies through intra-country pools of currencies. Revolut is another company in this space that charges 0% for remittances. They subsidize the cost in order to drive sign ups for their core bank account product which is the core of their business model. PIX and other real-time ACH networks also show that real-time payments can be free. However, the US lags the world in payments tech, partially a function of large number of banks here compared to anywhere else in the world and partially due to lobbying.

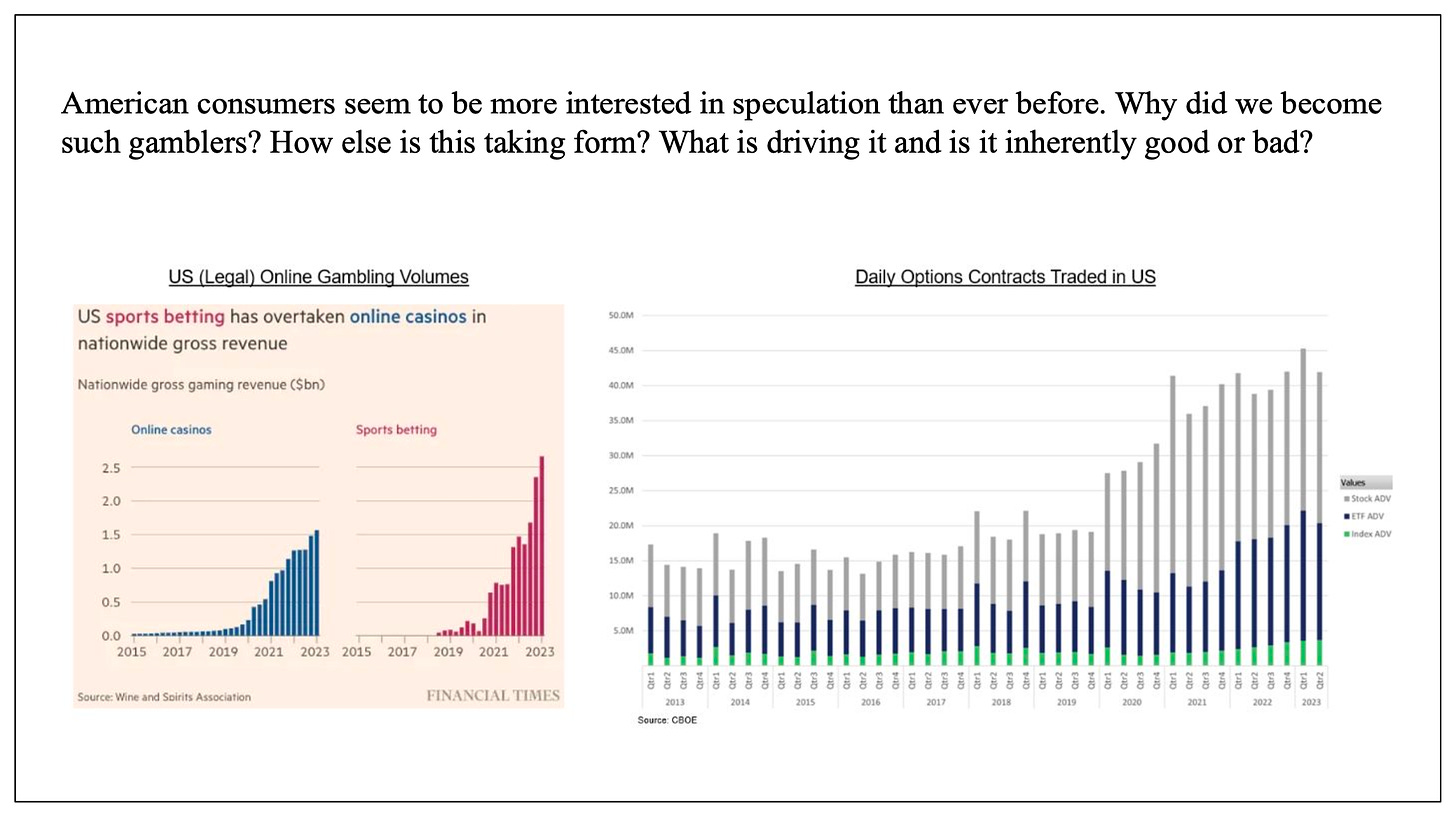

Is speculation inherent in human nature? Or indicative of loneliness and nihilism? To argue the latter, the US just recorded its lowest ever satisfaction scores for employed people. Perhaps people need an outlet as they battle their mental health challenges or economic challenges post-pandemic.

We also discussed how the internet seems to be spreading speculative waves faster than ever before. Pumping stocks used to be illegal on the internet and prosecuted. Now Reddit communities control the entire fate of certain public companies.

The government also seems to be letting speculation happen. China blocks crypto, we do not. Is this indicative of rising immorality? Society seems to be accepting crypto, marijuana, OnlyFans, sports betting, drug usage, options trading, and other behaviors - would these have been socially acceptable in decades past?

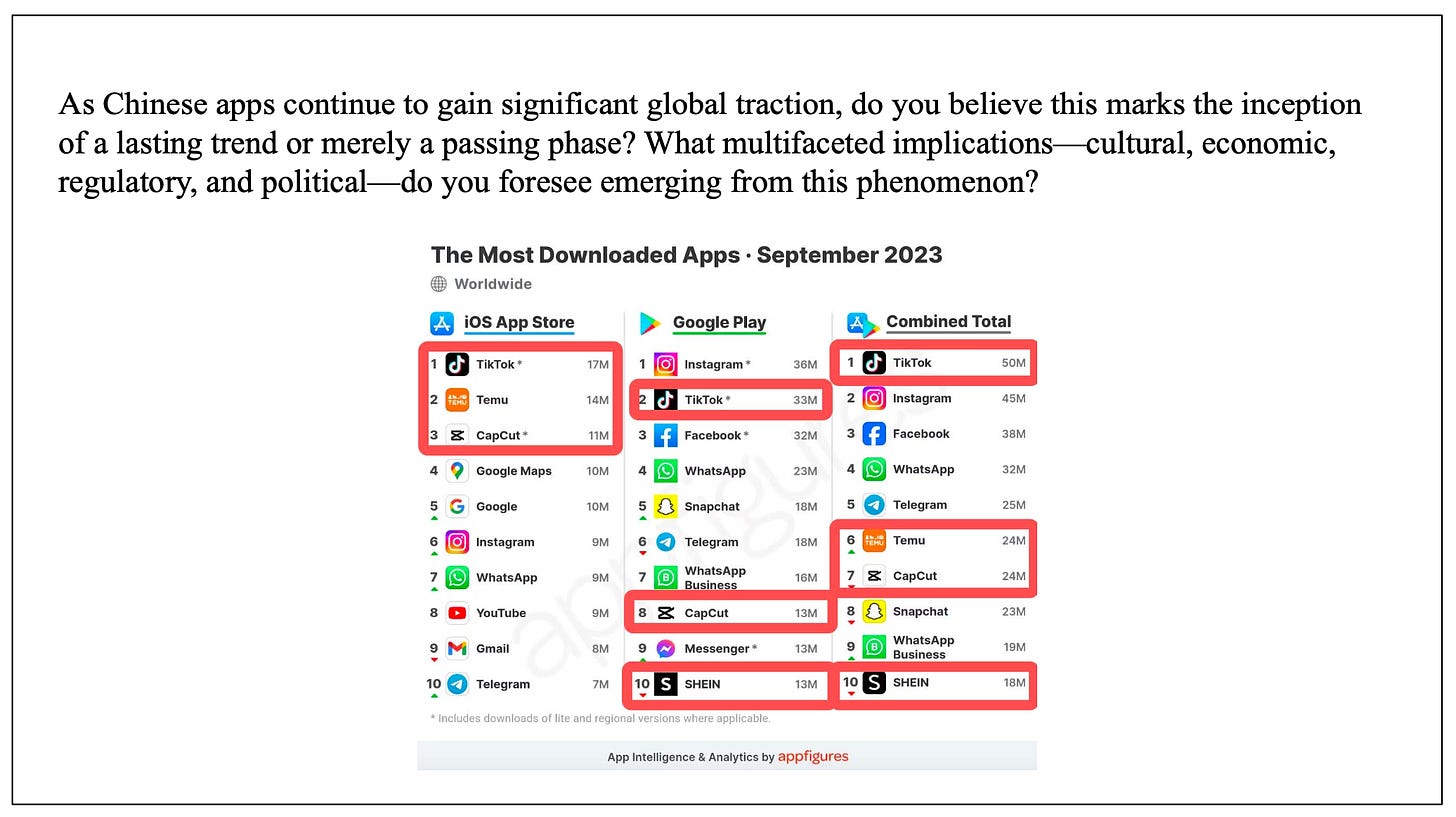

We discussed why Chinese companies were succeeding in the west and what the intentions are.

Success seems to be driven by 1) fast exploitation of an exportable business model and 2) products that are honed by domestic advantage. For example, Chinese companies invented AI-served short form video (think TikTok) by first building these apps for Chinese consumers (Kuaishou, Douyin). They then realized that social media companies outside of China hadn’t caught on and invested heavily to be first mover in other markets. Social media companies like Facebook and Snap weren’t asleep - they actually helped the Chinese companies grow by allowing them to become the top advertisers on their platforms. These Chinese companies, like Bytedance which owns TikTok, had huge amounts of domestic profits to invest in acquiring users abroad. They also have products that they honed domestically. Data from many of the ~2b internet users in China allowed TikTok to build the best content recommendation algorithms. Similarly, Shein taps China’s hundreds of millions of factory workers to produce very low cost clothing that it ships to the West. So perhaps its no surprise these companies come from China.

We discussed what the “end game” might be. After all, China isn’t truly a capitalist state where people are motivated to make the most money possible. In fact, billionaires in China have a high tendency to disappear… Is the end game political? Perhaps the Chinese government wants Shein to grow so it can maintain its globally dominant manufacturing economy. And perhaps the Chinese government loves having insight into what content users in the West are watching. Chinese companies are required to have government officials appointed in their ranks, so it seems likely that TikTok is a political weapon…

We generally believed that the US government is aware of these popular Chinese apps, is monitoring them, but is generally allowing Americans to use them. Is this naive? Are our aging government officials not bothered because they don’t understand how this can be used for harm? Or are we simply letting US consumers vote with their time/money like we always have? A recommended book on the topic is Attention Factory.

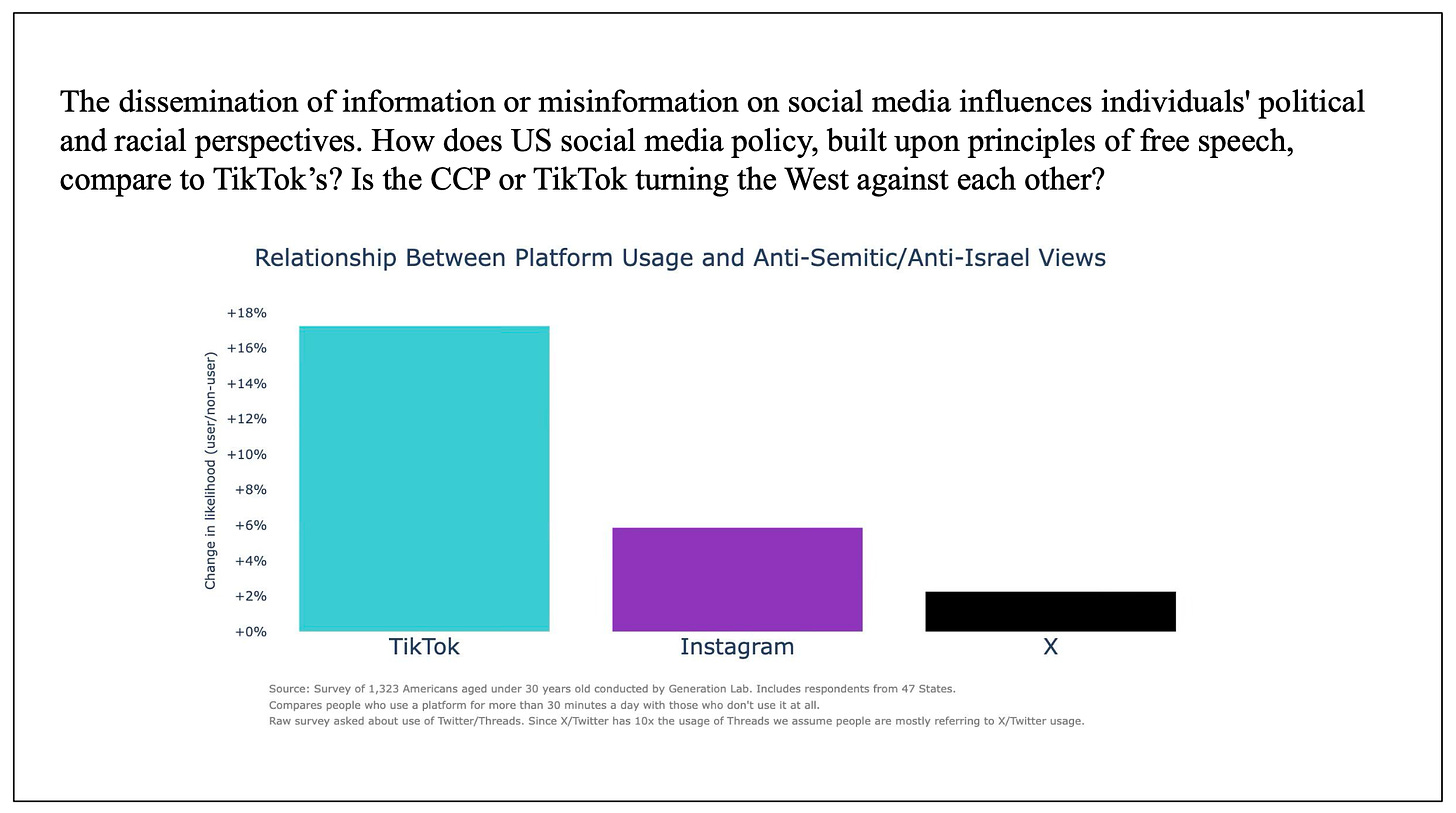

The TikTok algorithm reinforces your current views which make them even stronger. So is this a function of effective algorithms? One note - 3 of the 10 attendees use TikTok. One attendee called it “20 min of junk TV time.” But when we watched junk TV in the past (think Jersey Shore), MTV wouldn’t intersperse it with political content…

Is this a question of free speech? Or do we all agree that all mediums get exploited over time? In WW2, planes were dropping propaganda pamphlets constantly. Information is moving faster and technology is enabling more and more effective exploitation. Soon, synthetic videos will have an impact on our US political cycle.

Negative events also seem to compound. We had Russia/Ukraine and now Israel/Hamas. Less talked about are the recent events between Azerbaijan/Armenia, Venezuela/Guyana, and China/Taiwan.

We also discussed how social media seems to drive high severity of any major event. Moreso than ever before, it feels like the whole world gets caught up in an event during the first week. But we also all generally felt that social media causes a very fast fall off in attention for the major event. Attention spikes higher than ever before and falls off faster than ever before as people move on to other content. Are we both more connected and more isolated than ever before?

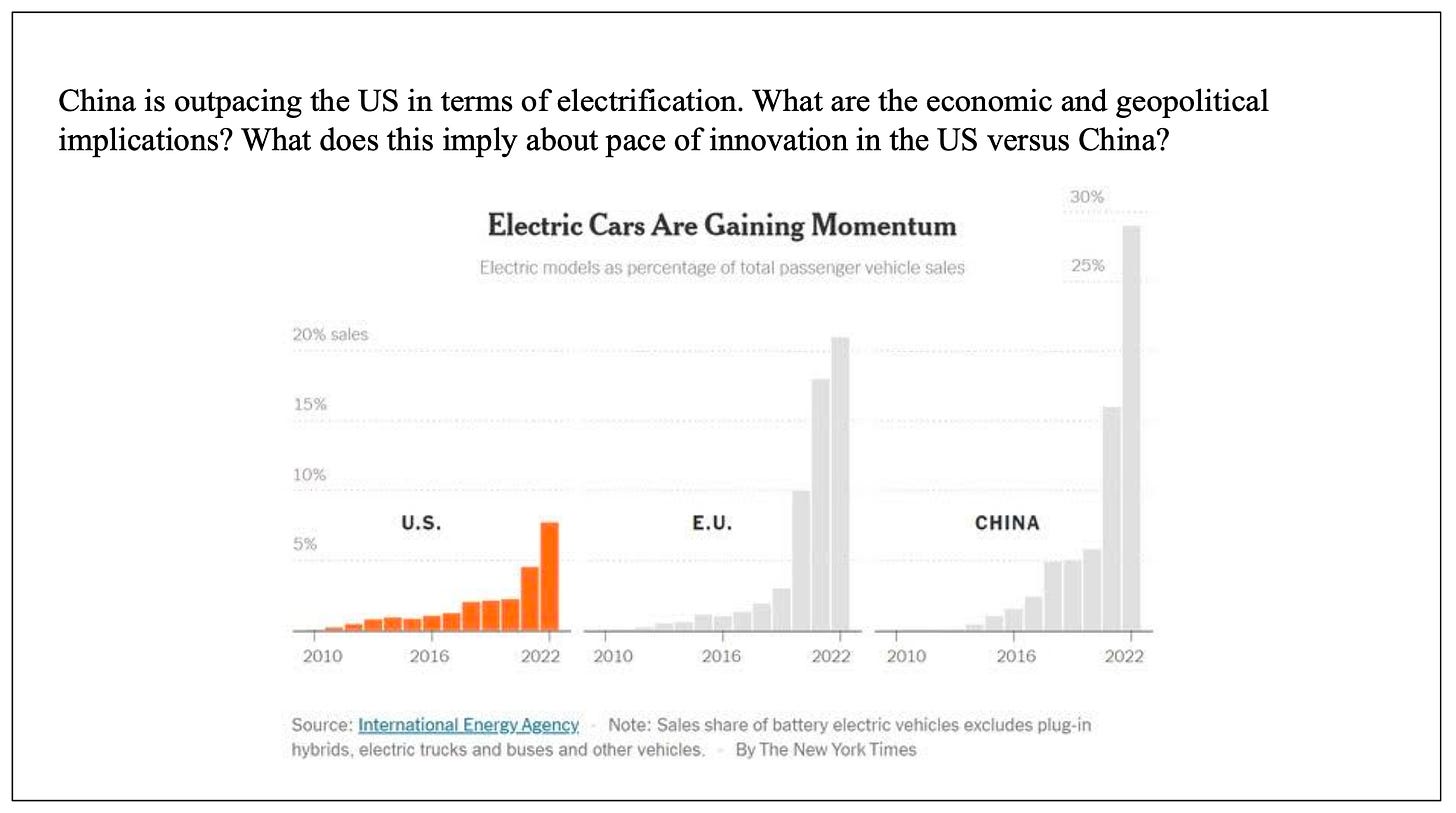

We discussed 1) why China is a leader in EV production and 2) if EV demand will keep growing.

China seems to have a “tops down” political mandate to produce EVs. It is part of their domestic push to reduce pollution which is major societal problem. In addition, China also has a huge advantage in supply chain since the country has large deposits of lithium and other rare metals that are used to make batteries. It also has a huge workforce to manufacture these goods and can fund factories with government dollars. So the economic incentive also exists which likely means that China will keep investing.

We tended to agree though that the EV movement may be overhyped. The cost may not actually be better - the depreciation of batteries, which only last 10 years, likely outweighs the gas savings of an EV. In addition, the narrative around the environmental impact may turn around as well. It is extremely carbon intensive to produce EVs, largely because of how inefficient it is to extract the required materials from the earth for batteries. Rare metals are really really rare - this video helps contextualize it.

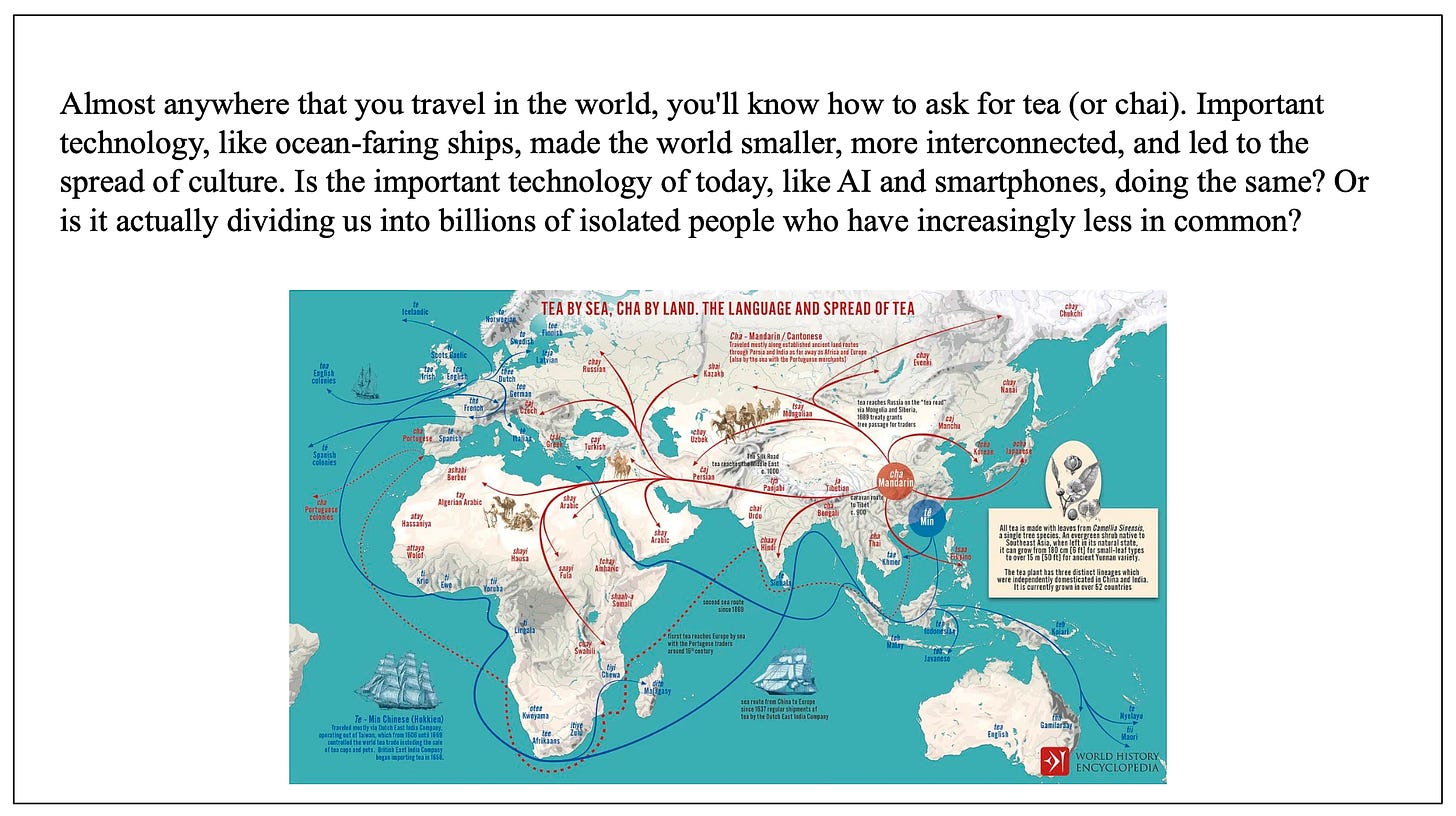

The world has been on a long arc of globalizing. But the pandemic caused a significant point of failure. We couldn’t get critical supplies in the US. This seems to have kicked off a trend of re-shoring or at least finding new allies/trade partners. Mexico and Brazil are on the rise and China is on the decline as a trade partner to the US.

The world feels more homogeneous in many ways - lot of big cities around the world feel quite similar, people dress similarly in many places now, lot of brands are available globally. But is the trend line around culture and how it’s spreading positive? Tying it to the tea/chai example in the chart, are we becoming more similar or more different? Or are we just realizing that the people who we see as similar to ourselves live somewhere else on the globe but we can now connect with them digitally? And that there are more different people on our planet than we could have imagined as well?

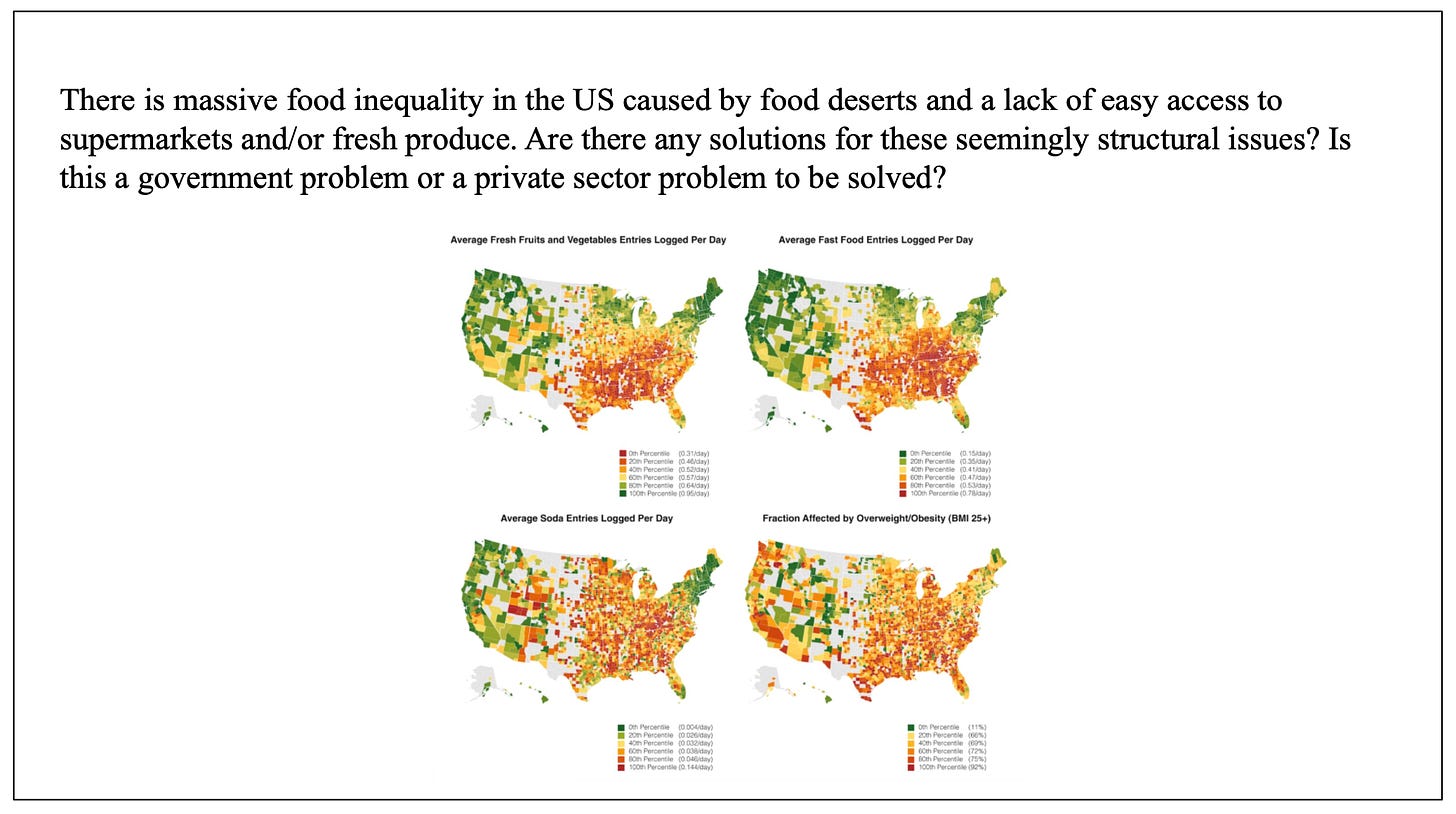

50% of Americans struggle to eat healthy food and 10% live in a food desert. People on the coasts are more privileged than people in the middle/south US. Is this a behavioral problem or an economic problem mainly?

We agreed that the US has solved a big problem over last 200+ years of starvation but perhaps we have taken it too far? Now people are eating themselves into problems. Is this a technology problem? Can we reengineer the foods that we eat to be better for us while still tasting good? Can education move the needle and shift demand to healthier foods as well?

But no doubt that at the core is likely an economic problem. If you can’t afford or access better food, then you have no way to eat better.

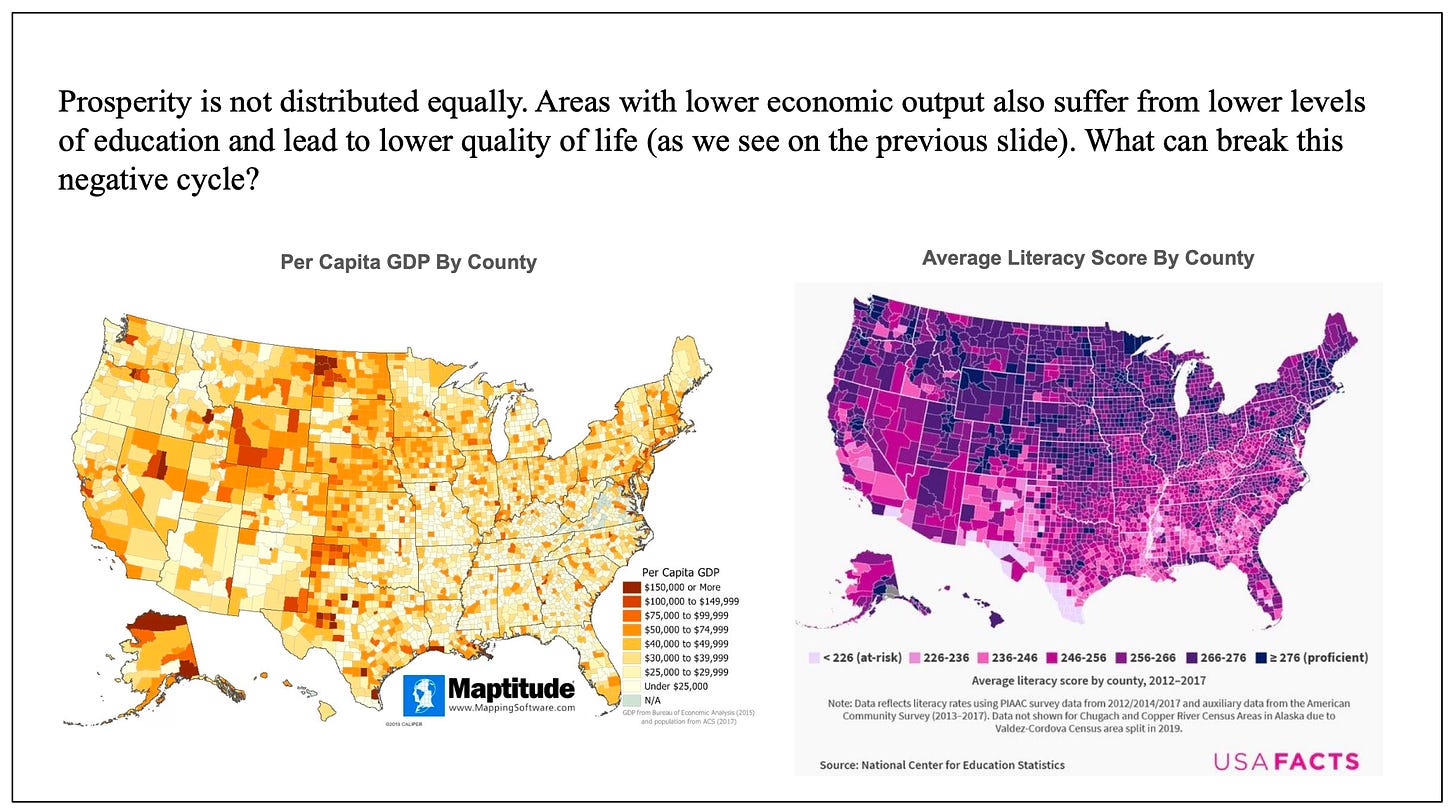

The previous chart is tied to this one. Economic prosperity is not evenly distributed in the US. Lower economic opportunity leads to lower education levels and to poorer nutrition. It’s quite a negative cycle. How does the cycle get broken? Is it a government problem or a private sector problem? Is it a story of “haves” and “have nots”? Would China see this and “tops-down” reallocate investment and labor to balance this out? Do we need more intelligent, motivated people in government to lead us in solving these problems?

Our internal political divide ties to all of this. If we built a Google in South Carolina, could we reunite our country? If so, how do we get started?